In a world of digital wallets, online shopping, and instant payments, teenagers are more exposed to money than ever before. However, most are not taught how to manage it wisely. Financial literacy is a crucial life skill, but many high school students graduate without even knowing how to create a basic budget. A practical guide should be provided for teens and their families to start building strong money habits early. That’s where this article comes in. From budgeting tips to credit basics, we’ll explore how teens can become financially confident and responsible. Let’s get started.

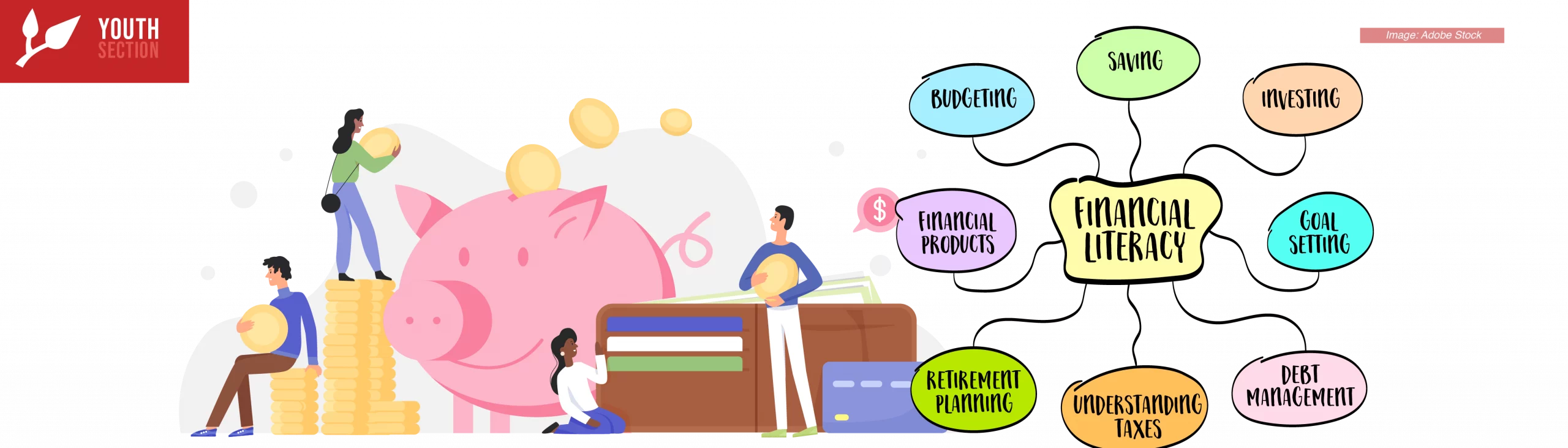

What is Financial Literacy?

Financial literacy means having the tools and the understanding to navigate everyday money choices and long-term planning with confidence. For teens, this includes understanding money, managing income, saving and investing, and using credit responsibly.

Teaching financial literacy to teens can help them avoid common financial pitfalls, reduce future debt, and increase long-term financial independence.

The Range of Financial Literacy Skills

The range of financial literacy skills includes household budgeting, managing debt, evaluating financial products, choosing investments, and more. Many of these skills require at least a working knowledge of key financial concepts, like ”compound interest” and “the time value of money”. Financial literacy can cover short- and long-term financial strategies. The strategy you use will depend on several factors, such as age, investment time horizon, and risk tolerance.

Additionally, financial products such as mortgages, student loans, health insurance, and self-directed investment accounts have grown in importance. E-wallets, digital money, and P2P lending can be convenient and cost-effective, but only if you know how to use them.

“It’s never too early, whether it’s teaching kids the value of a dollar, the difference between needs and wants, or the value of saving—these are all concepts that kids encounter at a very early age, so it’s best to help them understand it.” – Warren Buffett

What Are the Principles of Financial Literacy?

There are five broad principles of financial literacy. Although other models may list different key components, the overarching goal of financial literacy is to teach individuals about earning, spending, saving, borrowing, and protecting their money.

- Earning – Understanding how money is earned is essential to financial literacy. This understanding encompasses the effort involved in earning money and how income taxes, deductions, and net and gross income work.

- Spending – It supports all aspects of financial literacy. It involves knowing how to manage spending, budgeting effectively, understanding needs and wants, and making informed spending decisions. It also includes awareness about the impact of inflation on purchasing power so that individuals can make better purchasing decisions.

- Saving – Saving helps individuals work toward short-term goals (like buying a new gadget) and long-term goals (like buying a house or retirement). The importance of emergency funds (job loss, medical emergencies) also falls under this pillar.

- Borrowing – Borrowing involves understanding the various aspects of taking on debt, how interest rates work, and understanding repayment terms. Moreover, it demonstrates the long-term impact of debt on personal finance.

- Protecting – This deals with insurance, ID theft, and retirement planning. The goal is to stay safe on all levels of your life, including personal, health, and social areas.

Why Financial Literacy Is a Superpower for Teens

Financial literacy can be a powerful tool for teens. Think of financial literacy like a hidden life skill that protects your freedom to earn and spend with confidence. Below are just some of what this superpower can do:

- Promotes Financial Responsibility: Teens learn the difference between needs and wants and begin making better spending choices.

- Prevents Costly Mistakes: Understanding interest, credit, and budgeting helps teens avoid debt traps, such as payday loans or unnecessary credit card debt.

- Builds Long-Term Wealth: Learning about saving and investing early on sets the foundation for increasing wealth.

- Encourages Independence: Teens who learn how to manage their finances are better prepared to handle college costs, rent, and other adult responsibilities.

“The earlier you learn how interest, debt, and saving work, the more financial freedom you’ll have later.” — Anuj Sharma, Financial Planner

The Importance of Saving for Retirement

Financial literacy also includes knowing about retirement. It is important to plan and save enough for an adequate income when it comes time to retire. In its “Economic Well-Being of U.S. Households in 2022” report, the U.S. Federal Reserve System Board of Governors found that many Americans are not prepared for retirement. Twenty-eight percent of retired individuals had no retirement savings, while about 31% of those not yet retired did. Moreover, among those who had self-directed retirement savings, about 63% did not feel confident making retirement decisions.

If you are a teen or young adult, retirement could be decades away. However, starting to save now is the best move you could make. The earlier you start, the more time your savings have to grow. Employer-sponsored retirement accounts, such as a 401(k) or an individual retirement account (IRA), are good tools for this.

Key Financial Literacy Skills Teens Should Know

Developing financial literacy involves learning and practicing skills related to budgeting, managing debt, paying off debts, and more. Also, it means understanding and using credit and investment products wisely.

To effectively teach financial literacy to teens, parents and educators should cover these key topics in depth:

- Budgeting and Money Management

Budgeting is the cornerstone of personal finance. Teens should be taught how to:

- Track income and expenses

- Set financial goals (short-, medium-, and long-term)

- Use budgeting tools (apps like Mint, YNAB, or even pen and paper)

- Adjust budgets monthly based on changes in income or needs

- Divide money wisely using the 10–20% savings rule

A budget should include income (paychecks, investments), fixed expenses (rent, utilities, loan payments), discretionary spending ( eating out, shopping, travel), and savings. Additionally, teens can use an expense-tracking app, which can monitor their spending habits and help them save money.

The 10–20% Rule & Buckets System

Divide money into three buckets:

- Savings: 10–20% of all income (emergency fund, future goals)

- Needs: Fixed essentials (school supplies, travel)

- Wants: Entertainment, hobbies, gadgets

Example:

Earn $100 → Save $15–$20 → Spend the rest on essentials and fun.

Tools & Options for Better Money Management

Budgeting Tools:

Apps:

- Goodbudget: Simple digital envelope system

- Mint: Tracks spending and budget in real time

- Google Sheets: DIY budget tracker

- Student checking accounts: Stores money for needs and wants

Savings Tools:

- Student savings accounts: Store money for emergency funds, future goals, etc.

- Piggy banks or cash jars: Useful for visual tracking

- Recurring deposits: A fixed amount of money is deposited into a chosen account each month

- Pay Yourself First: Save before spending.

This is called a reverse budgeting strategy, another financial literacy skill. This method involves choosing and then sticking to a savings goal. You decide how much money you want to contribute toward this goal each month. Furthermore, it is important to set the money aside before dividing up the rest of your expenses.

- Needs vs Wants: Ask yourself, “Do I need this or just want it?”

It is important that teens understand the difference between “needs” and “wants”, especially if their money is limited. For example, it would be more important to replace their shoes full of holes instead of buying the latest video game. Focusing on needs and wants can encourage teens to really think about what they purchase. Furthermore, it may also help them to start budgeting.

- Clear Debt Monthly: Avoid interest by paying off credit card balances in full.

As we learned previously, financial literacy can be a powerful tool when it comes to preventing debt traps. Teens can use their budget to stay on top of debt by reducing spending and increasing repayment as needed. Also, developing a debt reduction plan can be useful, such as paying down loans with the highest interest rate first.

- Pay Bills Promptly

Paying bills late is a very expensive error to make. It is important to stay on top of monthly bills, making sure that payments are always delivered on time. Automatic payment withdrawals from a checking account are a good idea to prevent any missed or late payments. Payment reminders (by email, phone, or text) can also be useful.

- Weekly check-ins: Just like keeping track of monthly bills is an important part of financial literacy, so is monitoring your budget. Teens should spend at least 10 minutes reviewing their budget each week. This helps them to keep track of their spending habits more often and manage their money more effectively. Below is a detailed breakdown of some of the benefits of weekly check-ins:

- Builds awareness early – It lets teens see exactly where their money is going.

- Prevents overspending – Weekly check-ins act like speed bumps; they slow you down before you overshoot your spending limits.

- Keeps goals on track – Whether saving for a phone or a trip, weekly updates show progress and keep motivation high.

- Builds discipline and good habits – Money management becomes a regular habit with weekly check-ins.

- Catches problems early – Checking your budget weekly can also help you spot unexpected expenses before they derail your budget.

- Understanding Interest — Credit Cards & Student Loans

Credit Card Interest

- Average APR: ~21–22% in the U.S. (Business Insider)

- Interest compounds daily if you don’t pay the balance amount in full

Paying the “minimum due” keeps you in debt longer!

Tip: Use credit cards like debit cards—spend only what you can pay off at the end of the month.

Student Loan Interest

- Average federal undergraduate loan interest rate: ~7–8% (StudentAid.gov)

- As of August 2025, interest resumed for millions of borrowers in the SAVE plan, adding around $3,500/year on average per borrower (The Cut)

Tip: If possible, make small payments or pay interest during school to reduce your total cost.

How Parents Can Teach Financial Literacy to Teens

1. Model Good Behavior

Children often copy adult habits. Budget openly, avoid unnecessary debt, and discuss your financial decisions with your teen.

2. Have Open Conversations

Normalize talking about money. Discuss how you save for vacations, pay bills, and make decisions on large purchases.

3. Create Teachable Moments

Use everyday situations—like shopping, planning a trip, or buying a car—as lessons in budgeting, comparison shopping, and evaluating financial options.

4. Encourage Goal Setting

Work with your teen on setting specific goals: saving for a car, college, or a tech gadget. Help them break the goal down into achievable steps.

5. Use Educational Tools

Books, games, podcasts, and online courses can make financial literacy more fun for teens. Check out some of our recommendations below.

Resources and Recommendations for Teens

Books:

- Rich Dad Poor Dad by Robert Kiyosaki – It focuses on buying assets rather than liabilities. Assets are things that put money in your pocket, whereas liabilities cause cash to flow away from you.

- The Richest Man in Babylon by George S. Clason – It covers fundamental principles such as saving, investing, and avoiding debt.

- The Psychology of Money by Morgan Housel – This book explores the psychological aspects of money management and delves into the behavior and emotions that influence financial decisions.

- Money: A User’s Guide by Laura Whateley – It takes you on a journey from student loans all the way to pensions and investments.

TV Shows and Videos:

- The Minimalists: Less is Now –This documentary highlights the power of intentional living: cutting out the excess, reducing impulse spending, and spending only on what truly matters. It’s a full mental detox for your wallet.

- Two Cents – Two Cents is a YouTube series about personal finance. It breaks down financial concepts into fun, short videos and is produced by PBS Digital Studios.

- Get Smart With Money (on Netflix) – This documentary is a great way to learn about personal finance, offering actionable advice to help viewers improve their financial situation.

- Money, Explained (on Netflix) – This series covers everything from the history of money to the various types of financial institutions. It also explores topics like credit, debt, student loans, gambling, and retirement. It effectively breaks down complex financial concepts, making them easy to understand.

Board Games:

- The Game of Life – A great way to discuss career choices, income, and expenses.

- Time for Payback – It is an online game that simulates the financial decisions students must make to manage college life and beyond. Players have a chance to make choices about student loans, part-time jobs, and living expenses, all while trying to graduate without excessive debt. This game can be played on its official website: timeforpayback.com.

- Pay Day – Pay Day teaches money management by asking players to use their monthly paycheck wisely in order to meet monthly expenses. They will also learn how to build a savings fund.

- Charge Large – This board game teaches players how to maintain good credit and make wise purchase, borrowing, and payment decisions.

Raising financially literate kids is about helping them become responsible, empathetic, and self-sufficient individuals. By starting early, we empower them to build smart money habits that will serve them for a lifetime.

The Reality of Debt in the U.S.

- Student loans: Total U.S. federal student loan balances are around $1.63–$1.77 trillion, with 42–43 million borrowers. The average debt per borrower is roughly $38,000 (MarketWatch).

- Credit card debt: The average credit card balance for Americans with debt is around $6,580. Gen Z averages $2,834, about 26% more than millennials at the same age (LendingTree).

- Late payments: About 9% of people ages 18–29 are over 90 days late on credit card payments each year (OppLoans).

These numbers show why financial literacy is not optional—it’s essential.

The Bottom Line

Financial literacy is the knowledge of various aspects of personal finance and the ability to make smart money decisions. It includes preparing a budget, knowing how much to save, recognizing favorable (and unfavorable) loan terms, and understanding what impacts your credit score. Moreover, one can learn investment options that are useful for long-term goals.

Financial literacy for teens is more than just learning how to save—it’s about creating a mindset of financial independence, responsibility, and long-term planning. With the right tools and guidance, teens can enter adulthood with confidence and become “money smart”.

“Do not save what is left after spending, but spend what is left after saving.” – Warren Buffett

Read more articles related to personal development and financial literacy on our Zealousness blog Financial Literacy Programme and Articles for Youth – iN Education.

Disclaimer: The content in this article is for informational purposes only and is not intended as financial advice. We are not licensed financial professionals, and the ideas shared here are meant to encourage learning and exploration—not to replace guidance from a certified expert. Always consult with a qualified financial advisor before making financial decisions.