88% of Americans have stated that high school has not prepared them for handling money in the real world. According to the Ramsey website, 75% of U.S. adults felt stress due to money-related issues. As of today, most Americans agree that Financial Literacy is important.

What is Financial Literacy?

Financial literacy is the ability to manage and make decisions relating to personal finance. It can help you pursue financial freedom later in life when you can live without worrying about expenses or debt. Financial literacy provides you with the know-how to have the money to do the things you want to do.

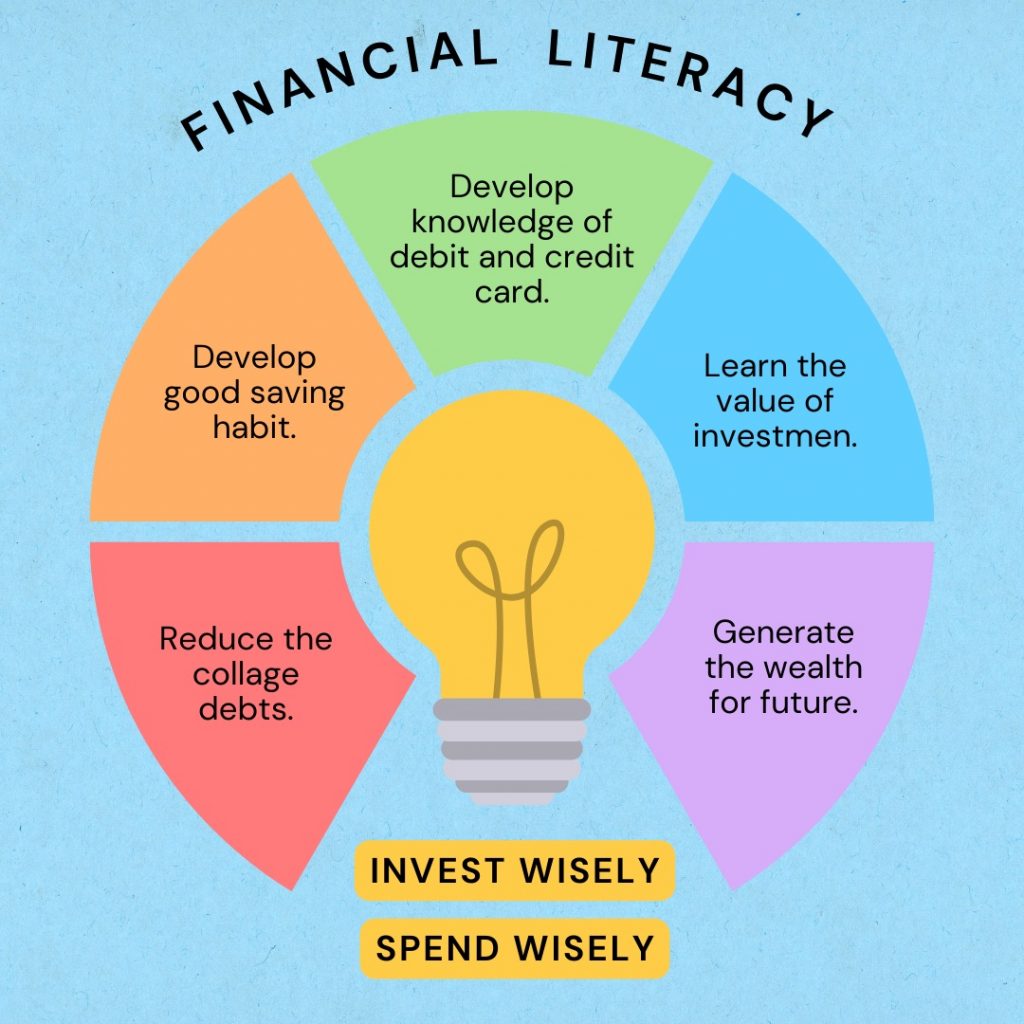

To start young is the key to sound finances. There are five main reasons why financial literacy for youth is so critical in today’s society.

- Help reduce college debt and the stress that comes with it.

College debt is one of the biggest concerns for young generations in America. According to Forbes, the average amount a borrower owes is $28,950. This creates the problem of how long students repay the loans. Unfortunately, many have not developed financial literacy or learned how to save appropriately for loans. By learning the basics regarding needs and wants, saving can increase tremendously. The younger you are, the more crucial it is to learn to save. Over time, loans will grow due to the interest rates. Most of the time, the stress associated with college debt grows because people have waited too long to pay off the loan. Teaching kids and young adults what it means to look for interest rates and to save will help reduce the amount of college debt that will build up.

- Help develop good saving habits.

Savings are a big part of financial literacy since it teaches habits on how to accumulate money for a need or want over a period of time. It is good to teach kids how to save when they are younger. This allows for less stress as they get older. An example of significant savings is a car, house, apartment, rent, etc. These big purchases will take time to save up for. Teaching kids how to save over time slowly will allow them to make wiser financial decisions regarding money. Even for little purchases, teaching kids to save will enforce lifelong habits that will benefit them later in life. This ensures confidence when it comes to managing money in the long term.

- Allow more generated wealth to help with future expenses.

The older you get, the more wealth people think you should generate. According to Smartassets, 60% of Americans over 65 still have debt that needs to be paid off. Generating wealth isn’t just to help you when you retire but to help you while you are young. Future expenses can be anything, such as a vacation, a car, a wedding, or even having a kid. Generating wealth allows you to have a bucket of money that can be accessed in an emergency. A couple of ways to teach children how to generate wealth for the future are through ETFs, Bonds, or even 401Ks when they get a job. Allowing kids the materials to generate wealth will help them in the long run and can help them live a more financially stable lifestyle.

- Help develop knowledge relating to debit and credit cards.

As time goes on, so does the use of technology. One of the biggest things about finance is the technology of debit and credit cards. Bankrate states that 77% of Americans own at least one credit card. Along with credit cards, debit cards were the most used payment method in 2022. Kids now can get debit cards at a young age if the parents approve it, says Alliant. To prepare a child for a credit and debit card, you need to teach them the responsibility of money. Teaching children and young adults how to use a debit card and how to pay back credit cards will help them develop the knowledge of how money works in the future. Credit cards are a big risk because they are tied to debt build-up. Introducing young adults to options like an Amex for students can give them a practical introduction to managing credit. As such, teaching kids about credit cards, interests, and credit scores allows a reduction of debt building up in the future.

- Learn the value of investments Such as stocks, bonds, and ETFs

Investments are one of the most significant ways individuals generate wealth over the years. Teaching children how these investments work can be very beneficial for their future. The younger you are, the more important it is to save for later in life. Investing early will allow your money to grow over the years through compound interest. A primary example of a compound is dividends. Dividends are monthly payouts, which allow investments to grow over time–generating more wealth.

Conclusion

Financial literacy helps younger kids and adults develop money skills and provides the necessary skills to thrive in the future. Teaching kids the value of money, credit cards, debit cards, and investments will allow them to make intelligent financial decisions in the future. It is not just about teaching money management; it’s about teaching them how to make decisions that will benefit their future.

References:

- Alliant Credit Union. “How to choose a teen debit card: What age can you get a debit card?” Alliant, 28 Sept. 2023, www.alliantcreditunion.org/money-mentor/how-to-choose-a-debit-card-for-minors#:~:text=along%20with%20it.-,What%20age%20can%20you%20get%20a%20debit%20card%3F,until%20the%20child%20turns%2018. Accessed 30 Dec. 2023.

- Chapek, David. “The Financial Illiteracy Cycle Is What’s Really Behind the Student Debt Crisis in America.” Fee Stories, 13 Dec. 2021, fee.org/articles/the-financial-illiteracy-cycle-is-what-s-really-behind-the-student-debt-crisis-in-america/. Accessed 30 Dec. 2023.

- Martin, Erik J. “Credit card ownership and usage statistics.” Edited by Sarah Gage. Bankrate, 21 Dec. 2023, www.bankrate.com/finance/credit-cards/credit-card-ownership-usage-statistics/. Accessed 30 Dec. 2023.

- Ramsey. 15 Dec. 2023, www.ramseysolutions.com/financial-literacy/financial-literacy-crisis-in-america#:~:text=In%20fact%2C%2088%25%20of%20all,managing%20finances%20for%20all%20Americans. Accessed 30 Dec. 2023.

- Reed, Eric. “60% of Americans Age 65 and Older Carry More Debt Than 30 Years Ago.” Edited by Jaclyn DeJohn. Smart Asset, 20 Oct. 2023, smartasset.com/retirement/bccrr-older-americans-more-debt-than-30-years-ago. Accessed 30 Dec. 2023.

- Tarver, Jordan, and Alicia Hahn, editors. “2023 Student Loan Debt Statistics: Average Student Loan Debt.” Forbes Advisor, 16 July 2023, www.forbes.com/advisor/student-loans/average-student-loan-debt-statistics/. Accessed 30 Dec. 2023.

- Woods, Sarah. “How Much Student Loan Debt Does the Average College Graduate Have?” US News, 22 Sept. 2023, www.usnews.com/education/best-colleges/paying-for-college/articles/see-how-student-loan-borrowing-has-changed#:~:text=However%2C%20a%20smaller%20percentage%20of,data%20reported%20to%20U.S.%20News. Accessed 29 Nov. 2023.