The world we live in is filled with constant, fast-paced changes. In order to adapt, we must keep up with the times, gaining knowledge of current topics and trends. Financial literacy is one crucial topic that should be given greater attention in the education system. It’s not always the most exciting or glamorous to learn about, but it certainly is an essential life skill that no one should be without.

Financial literacy plays a critical role in molding young adults ready to face the real world. Let’s explore why it is vital in today’s society and how it can set up students for success in their careers.

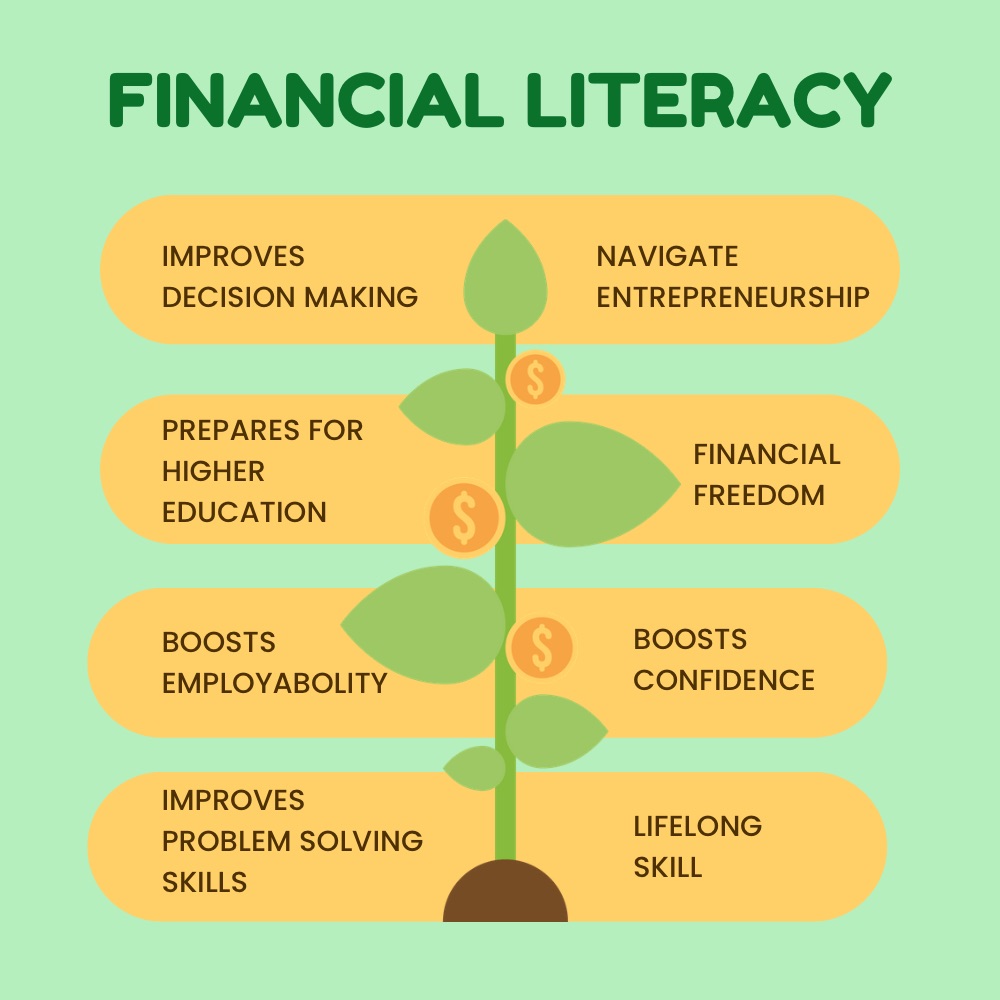

Financial Literacy Improves Decision-making

One benefit of financial literacy is that it instills good money habits early on. Students who are financially literate have a better grasp of the value of money and what it can and can’t buy. From saving to investing to developing the habit of living within their means, they can make informed decisions regarding their money.

This knowledge also helps them understand their actions’ more significant implications on their future and that of others, consequently encouraging responsibility. The earlier someone learns good money habits, the more likely they are to continue practicing them throughout their lifetime.

Financial Literacy Prepares Students For Higher Education

It is no secret that college tuition rates are skyrocketing, and the cost of attending college is becoming increasingly difficult to manage. College students need to be well-versed in financial concepts, like budgeting, borrowing, investing, and debt management, so that they can make smart financial decisions during their time at school. In addition, being familiar with the financial aid system will help them identify resources and potential scholarships to assist with their educational costs.

Financial Literacy Boosts Employability

Financial literacy is not just about managing personal finance. It can also enhance an individual’s career prospects. A comprehensive understanding of financial concepts is crucial for accounting, finance, and business administration professionals.

Employers in various industries continually seek employees with advanced technical skills and essential soft skills like financial literacy to create well-rounded teams. Financial skills requirements within the job description have increased throughout the decade, and having advanced financial knowledge could provide a candidate an edge when applying to such positions.

Financial Literacy Improves Problem-solving Skills

Students can learn how to budget, manage credit, and balance a checkbook through financial literacy. These real-world math skills are vital in tackling financial issues throughout their lives. Financial literacy skills allow individuals to think critically when faced with financial challenges such as debt, scams, and unexpected financial emergencies.

It’s not much of an exaggeration to say that in a fast-paced society such as ours, financial literacy is key to survival. One thing is for sure: financial literacy shouldn’t be limited to adults alone.

Financial Literacy Increases Confidence

Financial literacy also bolsters confidence levels and shifts misconceptions about money and wealth. Finance topics can be daunting and often shrouded in mystery, making one hesitant to tackle money matters. However, leaning into financial literacy can help one gain confidence in making informed decisions, which could lead to the attainment of more resources and success.

Financial Literacy Helps Navigate Entrepreneurship

Entrepreneurship is an excellent way for individuals to turn their ideas into reality. And who’s to say the next big idea won’t come from a student? Financial literacy equips young people with the necessary knowledge to become entrepreneurs. For instance, it is essential to have financial literacy skills to attract financial backing from potential investors and manage the company’s finances successfully. With an understanding of economic concepts and tools, such as taxes, budgeting, planning for investments, and banking operations, students can effectively maneuver through any startup challenge they might face.

Financial Literacy Creates Financial Freedom

Financial freedom is an integral part of overall happiness and security. It is the power to make choices about your finances and future without worrying about where money will come from. Financial literacy can help individuals break out of the paycheck-to-paycheck cycle, manage their debt and build a plan for long-term success. With this understanding, students can create strategies to help them reach their financial goals.

Financial Literacy Is a Lifelong Skill

Financial literacy is here to stay. It will continually impact the lives of individuals, regardless of their profession or income level. By teaching students financial literacy, they can become financially independent and make conscious decisions in their best interest.

Wrapping Up

Financial literacy is no longer an option but a necessity for achieving career success. It helps bridge the gap between a student’s knowledge and real-world applications. With financial literacy as a key competency, our young ones will be better prepared to take on the world and its ever-changing demands.

What are your thoughts on financial literacy and its importance in education? We’d love to hear from you! Feel free to share your experiences or views about this concept and how it has influenced your career development.

Read more stories from our Zealousness blog Education – iN Education Inc. (ineducationonline.org)